IMF policies deepened financial crisis, says CEPR

Thinktank report argues that fund's over-optimistic assumptions on economic growth exacerbated global downturn

- guardian.co.uk, Monday 5 October 2009 14.36 BST

- Article history

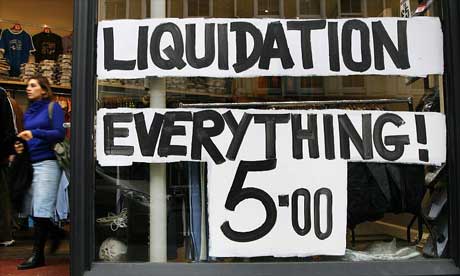

The influential thinktank CEPR claims the IMF should have been more careful with its recession policies. Photograph: Luke MacGregor/Reuters

Policies implemented by the International Monetary Fund (IMF) during the global downturn further exacerbated the crisis in many countries, a leading thinktank said today.

In a paper analysing the IMF's agreements with 41 borrowing countries during the crisis, the Washington-based Centre for Economic and Policy Research (CEPR) found that 31 of the agreements contained so-called "pro-cyclical" macroeconomic policies, which – in the face of a significant slowdown in growth or in a recession – would be expected to exacerbate the downturn.

"In many cases the fund's pro-cyclical policies were based on over-optimistic assumptions about economic growth," said the thinktank. This means the measures proposed were too restrictive for the countries involved and did not produce the longer-lasting economic growth predicted.

In nearly half of the countries that have had at least one review, the IMF's analysts had to lower their previous forecasts of real GDP growth by at least three percentage points, and in a few cases they had to correct forecasts that were at least seven percentage points overestimated. "Most likely there will be more downward revisions to come," the CEPR said.

"The fund might respond that it could not be expected to anticipate the depth of the world recession and its impact on developing countries through exports, capital inflows, remittances, access to trade credits and other channels.

"But the fund should have been more careful in its projections and should have anticipated a severe downturn that would have serious effects on low- and middle-income countries."

The CEPR suggested the IMF had learned few lessons from the past. For example, in Latvia the fund had encouraged the government to preserve a pegged exchange rate. This is similar to the IMF-supported policy in Argentina during its steep recession of 1998-2002, "where a fixed, overvalued exchange rate was supported with tens of billions of dollars of loans until it inevitably collapsed".

"In cases such as Argentina and Latvia, maintaining the peg means that adjustment must take place through shrinking the economy and real wage declines. Latvia's GDP is projected to shrink by 18% this year," the thinktank reports.

The CEPR also criticised the IMF for failing to foresee the cause of the US recession, which officially began in December 2007.

"Some economists began writing about the housing bubble in 2002, and while no one could anticipate exactly when it would burst, [co-director of the CEPR, Dean] Baker continuously tracked the magnitude of the bubble; and well before it peaked in 2006, it was clear that this would have a huge impact on both the US and world economy."

The CEPR said that all of this data and analysis was available to the fund, which has one of the largest economic research departments in the world. "The fund publishes the World Economic Outlook every six months, the purpose of which is to analyse current trends; the WEO missed this enormous bubble and its likely consequences."

The CEPR says it is now time for the IMF to re-examine the criteria, assumptions and economic analysis that it uses to prescribe macroeconomic policies in developing countries.

In response to the findings, the IMF said: "The CEPR reaches seriously misleading conclusions about the pro-cyclicality of policies in IMF-supported programmes, relying on faulty analysis and often inaccurate information.

"The main point of this report is that growth forecasts were too optimistic when programs were designed, leading to excessively tight fiscal and monetary policies. Reality is quite the opposite.

"In virtually all programmes, fiscal targets were quickly and substantially relaxed once the extent of the crisis became apparent. Monetary and fiscal policies have deliberately sought to offset the fall in global demand."

No comments:

Post a Comment