What was really behind last year's market crash?

In an exclusive extract from his new book, John Cassidy explains why the huge salaries of Wall Street bosses created a culture that helped trigger the financial crisis

- The Guardian,

- Wednesday 25 November 2009

- Article history

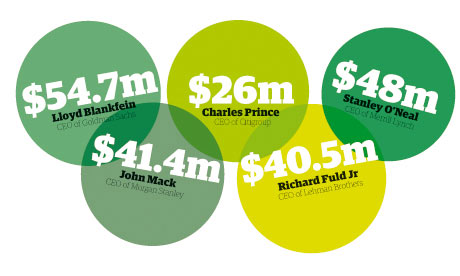

Figures are payments made to American banking bosses in 2006, the 'bubble' year. They include annual salary, cash bonuses, share and stock options

- How Markets Fail: The Logic of Economic Calamities

- by John Cassidy

- 400pp,

- Allen Lane,

- £25.00

But during Alan Greenspan's era in charge of the US Federal Reserve, lax monetary policy, deregulation and financial innovation shocked the economy out of its stable configuration, placing it on a "bubble path". No single one of these factors can be held solely responsible; it was the combination that did the damage.

There was, however, another factor that played an important role: the enormous incentive packages that many traders and senior executives on Wall Street received. Once the credit bubble got started, the men who ran the biggest financial institutions in America were determined to surf it, regardless of the risks involved. Because from where they sat, and given the financial incentives they faced, pursuing any other strategy would have been irrational.

The problem of excessive pay isn't peculiar to Wall Street; its effects just happen to be more pernicious there. When a highly paid rogue CEO such as Enron's Kenneth Lay or WorldCom's Bernie Ebbers creates or condones a culture of deception in a misguided effort to boost their firm's stock price, the consequences for the employees and stock-holders of the company can be severe. And when a Wall Street CEO levers up their firm's equity capital 30 or 40 to one in search of extra profits, their actions can bring down the entire economy.

Yet Wall Street remuneration schemes take no account of this. When the markets are rising and deals are getting done, traders, investment bankers and their bosses are paid magnificently; when things go wrong, the shareholders of the firms and, in extreme circumstances the taxpayers, suffer the bulk of the losses.

The market failure begins on the trading floor, where individuals have an incentive to take excessive risks with the firm's capital. A useful way to think about them is as entrepreneurs who enter profit-sharing agreements to rent out part of their firms' balance sheets. Without access to cheap funding, even the smartest trader is helpless. But with the backing of a mighty Citigroup or Goldman, he can make enormous bonuses.

Some trading desks give their employees up to half of the profits they generate above a certain target. However, the trader's downside is capped. If his trades generate large losses, he might lose his job, but he doesn't have to write the firm a cheque to cover the cost of his mistakes. If his trades turn out badly, the firm has no recourse to his personal assets, or even the bonuses he earned in previous years.

Another way to characterise such arrangements is as a "trader's option", because they give the employee a free option on the upside to his trades. Of course, the top executives of financial firms have the responsibility of managing the risks their institutions take on. Yet in many ways, they face a similar set of incentives to the ones facing traders. If things go well, the firm's shares go up, and so does the value of the bosses' stock options. If things go badly, they have extremely generous "retirement" packages to fall back on. In fact, the "CEO's option" turns out to be an even bigger problem than the trader's option. Even the most gung-ho trading desks face some trading limits; Wall Street CEOs can, and have, put entire firms on the line.

The rise of stock options

The development of elephantine compensation packages for Wall Street CEOs followed the pattern of other industries. During the 1960s and 70s, many commentators and investors expressed concern that CEOs were more interested in building up personal fiefdoms, complete with lavish headquarters, plush corporate resorts and private jets, than in acting in the interests of shareholders. In an extremely influential paper published in 1976, Michael Jensen, now of Harvard, and the late William Meckling depicted the relationship of CEOs and stockholders as a "principal-agent" problem.

As anybody who has hired a contractor knows, it can be difficult to monitor their behaviour: the contractor may say he is working diligently, but is he telling the truth? With public companies, the shareholders are the principals and the CEO is their agent. Since corporations are big and complicated, it is hard to tell from the outside whether a CEO is doing a good job.

One way to align the interests of stockholders and the CEO is to remunerate the latter with large numbers of shares, or stock options. If that were done, Jensen and others argued, CEOs would come to view themselves as owners instead of hired employees, and the result would be much better management.

"On average, corporate America pays its most important leaders like bureaucrats," Jensen and Kevin Murphy, an economist now at the University of Southern California, argued in a 1990 article. "Is it any wonder that so many CEOs act like bureaucrats, rather than the value-maximising entrepreneurs companies need to enhance their standing in world markets?"

Corporate America sat up and listened. As recently as 1980, fewer than one in three chief executives had been granted stock options; by 1994, the proportion had risen to seven in 10. In the ensuing years, enormous options grants became the norm, enabling prominent CEOs such as Jack Welch, of General Electric, and Michael Eisner, of Disney, to build up fortunes worth hundreds of millions of dollars .

The Jensen doctrine quickly spread to Wall Street, where executives such as Sanford "Sandy" Weill of Citigroup, and Maurice "Hank" Greenberg of AIG, accumulated dynastic wealth. Some free-market economists credited the changes in remuneration structure with reinvigorating corporate America. But even Jensen eventually conceded that it also created serious problems – many of which came to light during the great accounting scandals of 2001–02.

"I was a defender of the move toward stock options and more liberal rewards for CEOs," Jensen told me in 2002. "But I'm now a critic of where we got to."

It was no coincidence that the accounting scandals emerged after the bursting of the technology stock bubble. Many firms' stock prices had become wildly overvalued, and their managers, pockets bulging with stock options, were struggling to create profits that would justify them. "For a long time now, we've had a situation in which the stock prices of many firms had been too high," Jensen went on. "That is to managers what heroin is to a drug addict."

Why CEOs liked risky bets

On Wall Street, many decisions, such as whether to enter a certain business or underwrite a certain deal, can be thought of as risky gambles. In certain states of the world, they will pay off; in others, they won't. It is a fundamental principle of corporate finance that firms should carry out projects that are expected to generate economic profits, and forgo projects that are expected to result in a loss.

Consider a bank thinking of participating in a deal that has a two-thirds chance of producing a $60m profit, and a one-third chance of generating a $60m loss. A bit of simple arithmetic suggests the net expected profit of this deal is $20m ([⅔ x $60m] – [⅓ x $60m]) = $20m. The bank should go ahead with the deal.

Now consider another, bigger prospect. This one has a 99 in 100 chance of generating a profit of $100m, and a one in 100 chance of generating a loss of $10bn (the deal might involve entering a new business line, such as investing in mortgage securities). In this case, the venture's expected value is a loss of $1m ([99/100 x $100m] – [1/100 x $10bn] = –$1m), and the bank should turn it down. But will its CEO do that?

Let's assume the CEO is paid $2m a year plus a bonus equal to 2% of the firm's profits. If they accept the deal, there's a 99% chance it will pay off; they will earn $4m (salary plus a bonus of $2m). If they accept the deal and the unlikely occurs, the bank will have to write off $10bn, but they will still earn $2m.

This example shows that Wall Street CEOs can have an incentive to accept risky bets that aren't in the long-term interest of their firms. In the long run, unlikely things happen, and now, finally, some economists are recognising these problems.

In a 2009 paper, Lucian Bebchuk and Holger Spamann, of Harvard Law School, pointed out that giving a Wall Street CEO a big package of stock options amounts to giving them a heavily levered and one-sided bet on the value of the firm's assets. If the bank's investments do well, the stockholders, including the CEO, get to pocket virtually all the gains. But if the firm suffers a catastrophic loss, the equity holders quickly get wiped out, leaving the bondholders and other creditors to shoulder the bulk of the burden.

"These highly levered structures gave executives powerful incentives to take excessive risks," Bebchuk and Spamann note. Indeed, under certain circumstances, a rational Wall Street CEO "will be willing to literally bet the bank".

But in the midst of a credit bubble, sitting on the sidelines simply isn't a realistic option for somebody running a big, publicly owned financial institution. The main reason Wall Street CEOs receive such big pay packages is to encourage them to deliver extraordinary growth. Controlling costs and maintaining product quality are two of their tasks, but it is rapid expansion in market share that fires up a firm's stock price and raises the boss's standing.

So, even if the Wall Street chiefs privately harboured reservations about moving into risky areas such as subprime lending, once their rivals had entered the field – and were making money – they were forced to follow.

The experience of Chuck Prince at Citigroup provides an illuminating case study. By the end of 2004, Citigroup's investment banking arm was widely perceived to be falling behind its rivals. Prince, who had taken over as CEO in 2003, came under pressure to rev it up. At the start of 2005, according to the New York Times, Citi's board asked Prince and his colleagues to develop a growth strategy for the bank's bond business. One of the most senior board members, Robert Rubin, advised Prince to raise Citi's tolerance for risk and expand its activities in rapidly growing areas, provided the firm also upgraded its oversight of them. "We could afford to seek more opportunities through intelligent risk taking," Rubin later told the New York Times. "The key word is 'intelligent'."

Theoretically, Prince could have refused to act on Rubin's advice and told the board he didn't think it was a good idea for a bank of Citi's stature to take on more risk, however intelligently it was done. But Citi's stock price hadn't gone anywhere in five years, and its rivals were already heavily involved in riskier areas such as mortgage bonds.

Being cautious would have involved forgoing a significant growth opportunity – something Prince, whose authority was already being questioned, couldn't afford to do. He authorised a rapid expansion of Citi's securitisation businesses, especially those dealing with subprime mortgages and loans from private equity companies.

Given what everybody else was doing, it was the rational thing to do. This was the context for Prince's famous interview with the Financial Times in July 2007, in which he said: "As long as the music is playing, you've got to get up and dance."

In June 2007, just a few weeks before that interview, the investment bank Bear Stearns had been forced to inject $3.2bn into two hedge funds it managed, which had suffered big losses on their holdings of subprime securities. Prince then conceded that a full-scale blow-up in the subprime market could leave Citi and other banks saddled with numerous loans of questionable value that they couldn't sell. And yet still, he insisted, Citi had no intention of pulling back.

Prince's reference to dancing and the game of musical chairs was a remarkably candid description of the situation in which he found himself. Some Wall Street CEOs at times appeared blissfully unaware of the risks their firms were taking. But Prince was here openly acknowledging the possibility of a catastrophe and saying that despite it all, he and Citi would continue to surf the bubble, hoping to get out before they came a cropper.

Whether he knew it or not, Prince was referencing John Maynard Keynes, who, in his seminal 1936 work, The General Theory of Employment, Interest and Money, pointed to the inconvenient fact that "there is no such thing as liquidity of investment for the community as a whole". In other words, if everybody tries to sell it at the same time, prices will collapse and the market will seize up.

"It is," wrote Keynes, "so to speak a game of Snap, of Old Maid, of Musical Chairs . . . These games can be played with zest and enjoyment, though all the players know that it is the Old Maid which is circulating, or that when the music stops, some of the players will find themselves unseated."

In the wake of last year's crash, even some top bankers have conceded that Wall Street remuneration schemes lead to excessive risk-taking. Lloyd Blankfein, the chief executive of Goldman Sachs, has suggested that traders and senior executives should receive some of their compensation in deferred payments. A few firms, including Morgan Stanley and UBS, have introduced "clawback" schemes that allow the firm to rescind some or all of traders' bonuses if their investments turn sour.

But without direct government involvement, the effort to reform Wall Street compensation won't survive the next market upturn. For although the financial sector as a whole has an interest in controlling rampant short-termism and irresponsible risk-taking, individual firms have an incentive to hire away star traders from any rivals that have introduced pay limits. Compensation reforms, therefore, are bound to break down.

In this case, as in many others, the only way to reach a socially desirable outcome is to enforce compliance. And the only body that can do that is the government.

No comments:

Post a Comment